<- Back

Konan AI

Leading a strategic pivot from MLOps tool to business-focused credit decisioning platform

From Abstract Vision to $250K in Sales

We need to tell a compelling story to secure early customers

The CEO had a bold vision: bring AI to non-technical businesses. But it was just that a vision. The sales team needed something concrete to show potential clients.

I translated complex AI concepts into realistic prototypes that clearly demonstrated business value.

The result? $250,000 in early deals secured, providing crucial validation and funding.

Building Strategy from Uncertainty

I need to understand what we're actually building before I can design it

Faced with a vague "AI for businesses" vision, I structured a discovery process to define the real opportunity:

1. Stakeholder Alignment Workshops

- Facilitated sessions with CEO, sales, and engineering to align on vision

- Created problem statement frameworks to clarify business objectives

- Mapped current customer assumptions vs. validated insights

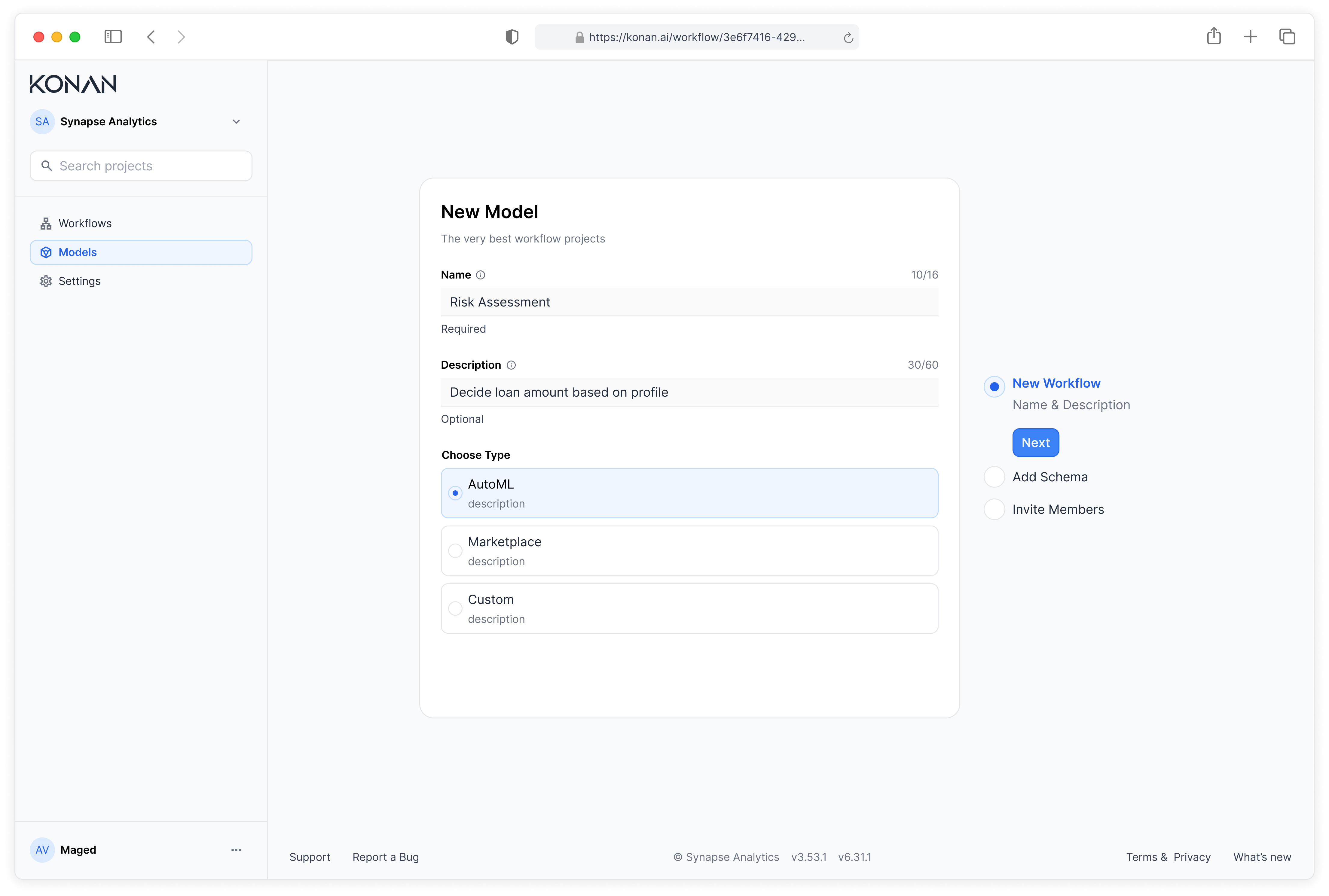

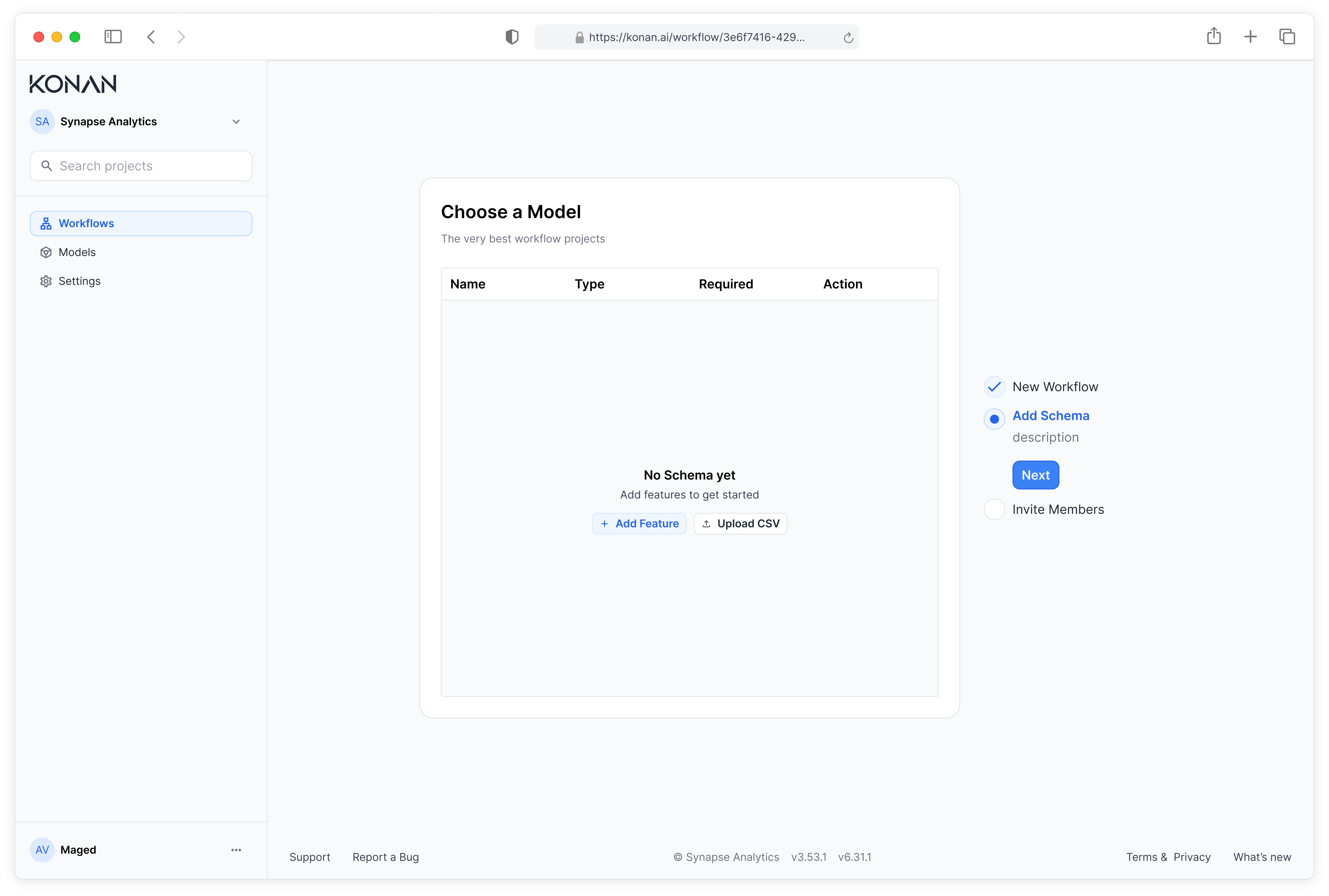

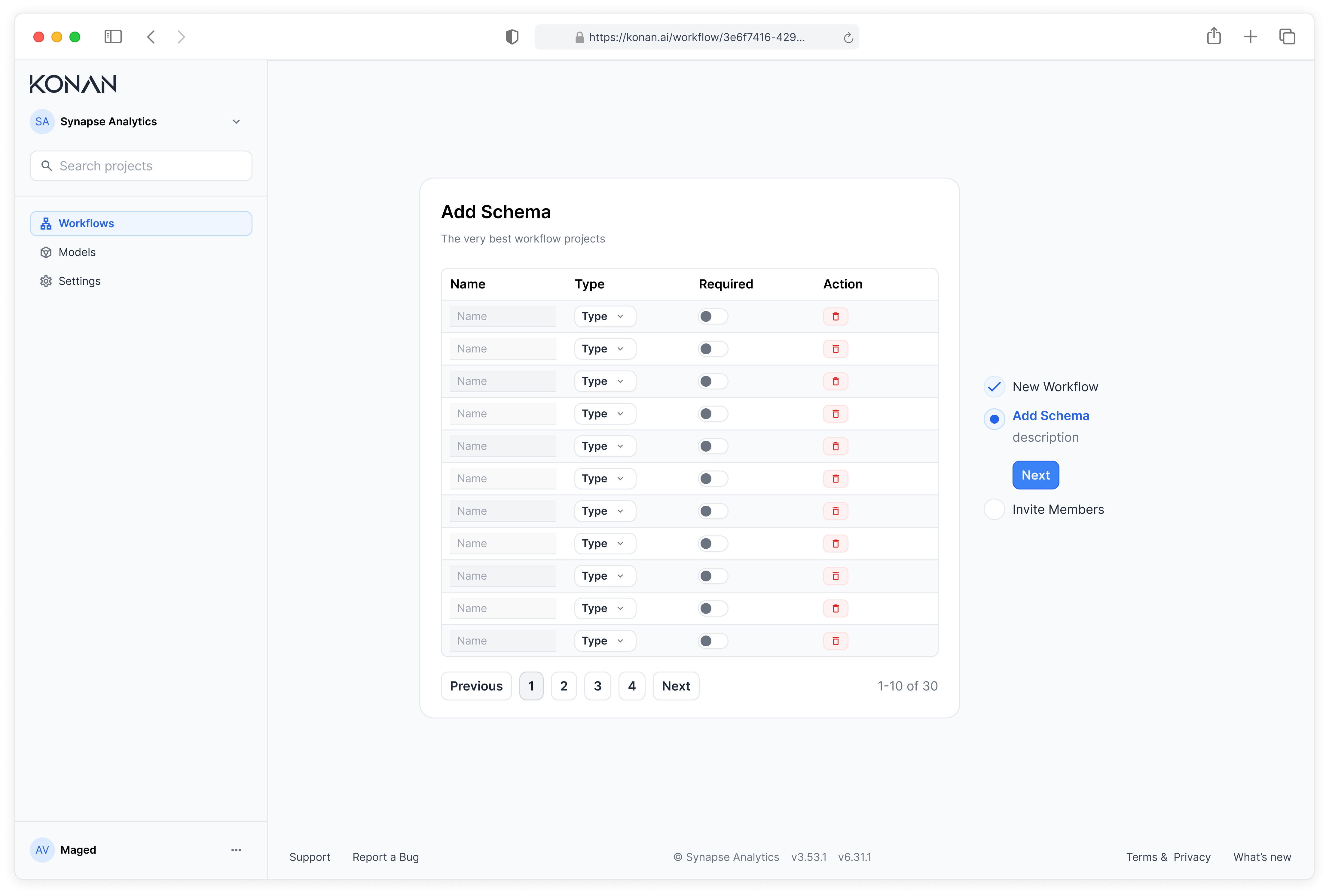

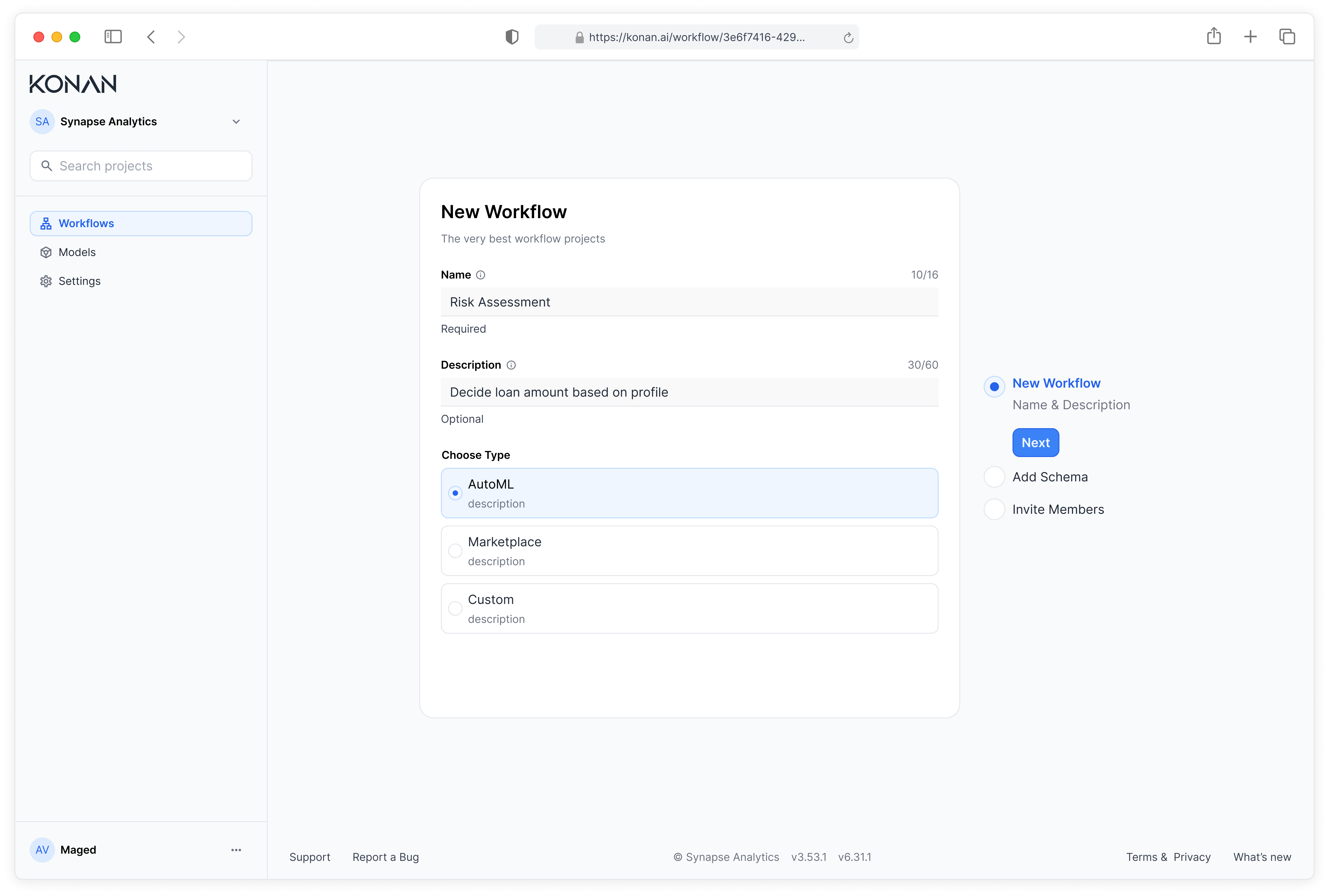

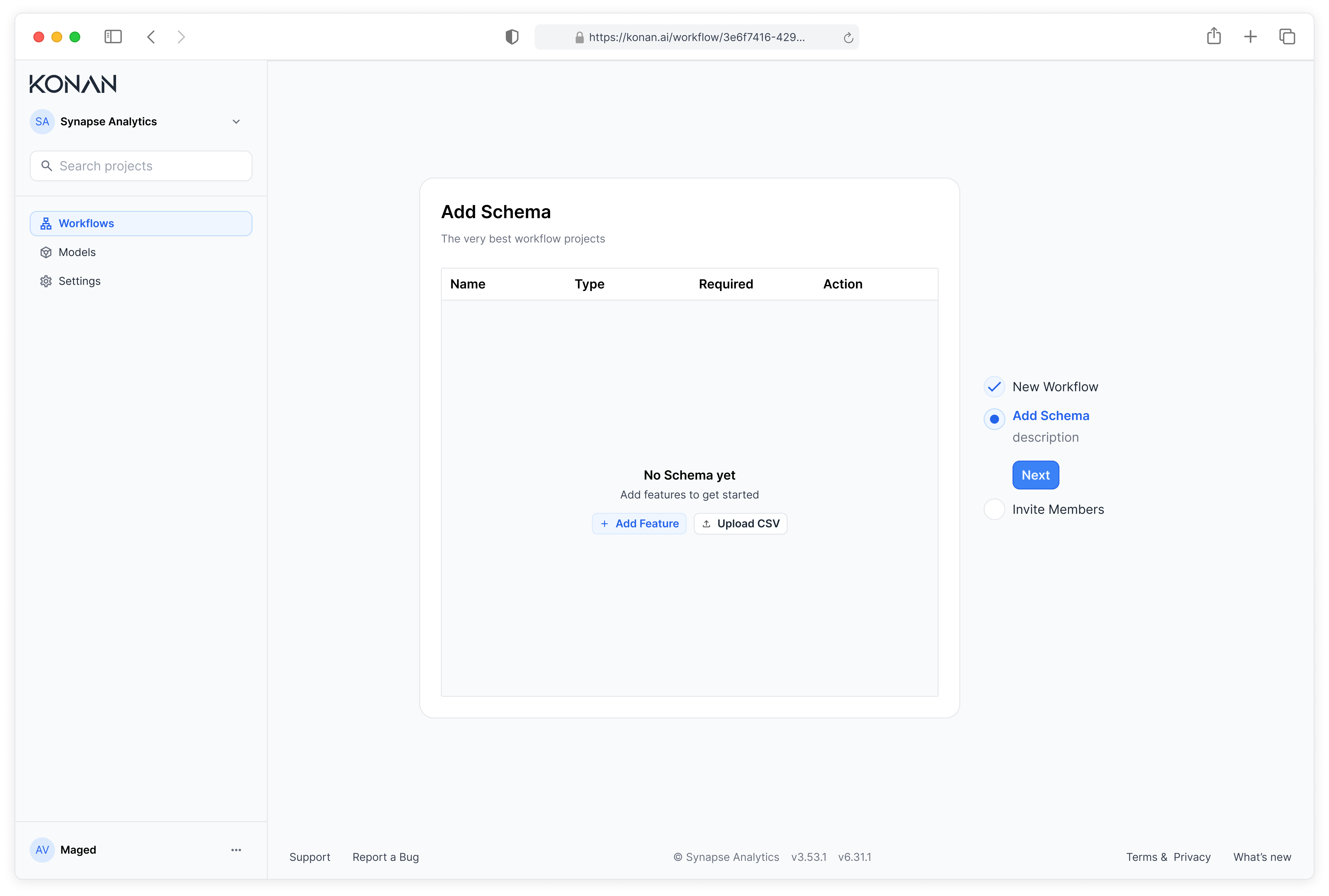

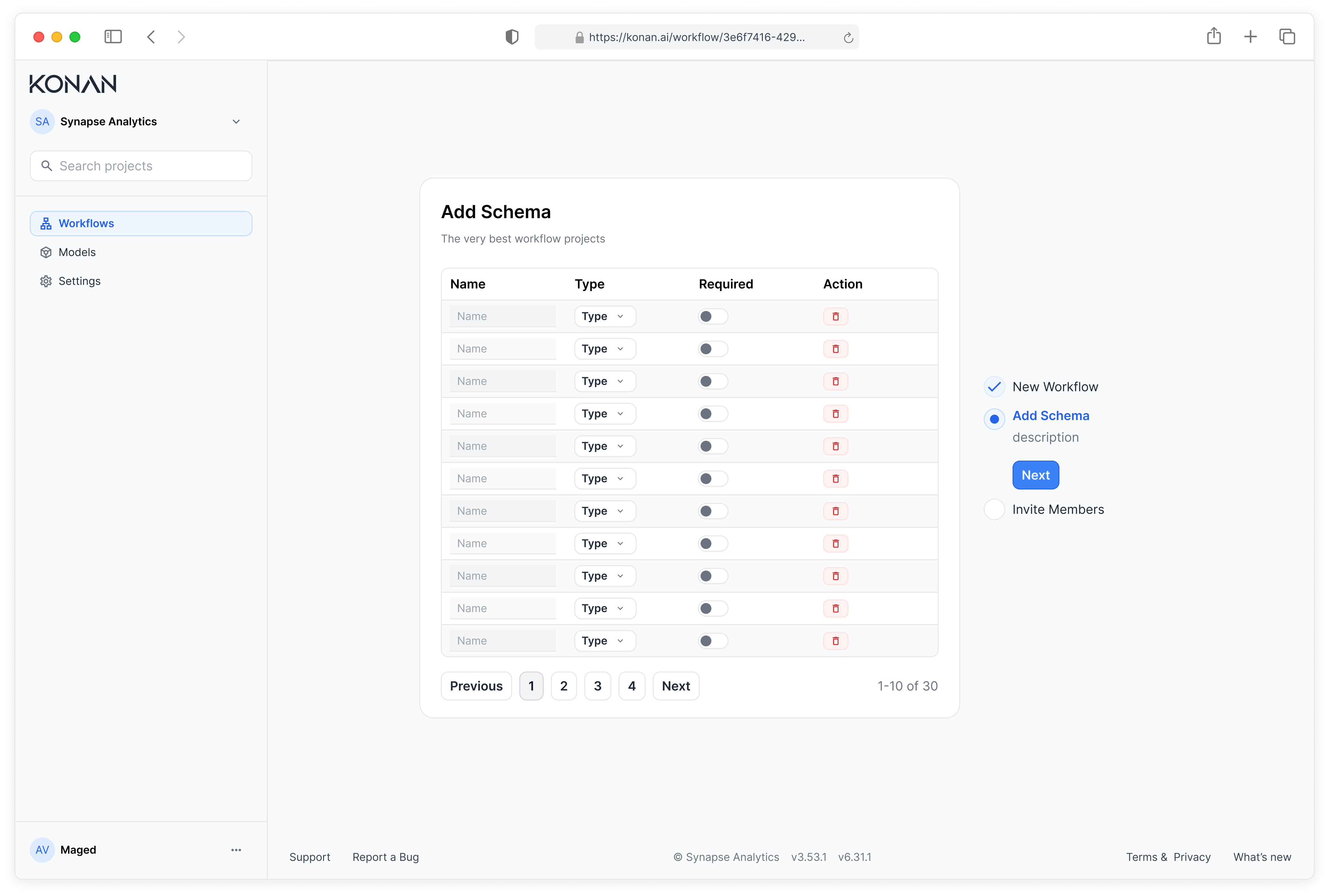

2. Rapid Prototyping for Sales Validation

- Built clickable prototypes in 2 weeks to test value propositions

- Created 3 different product narratives for market testing

- Designed sales demo flows that showed concrete business outcomes

3. Technical Feasibility Mapping

- Collaborated with data scientists to understand AI model constraints

- Defined MVP scope based on technical reality vs. market need

- Created design-to-development handoff process for 3-month timeline

Key insight: The best design process adapts to business constraints. With limited time and undefined requirements, I prioritized rapid validation over perfect documentation.

Building an MLOps Platform in 3 Months

We have 3 months to build this

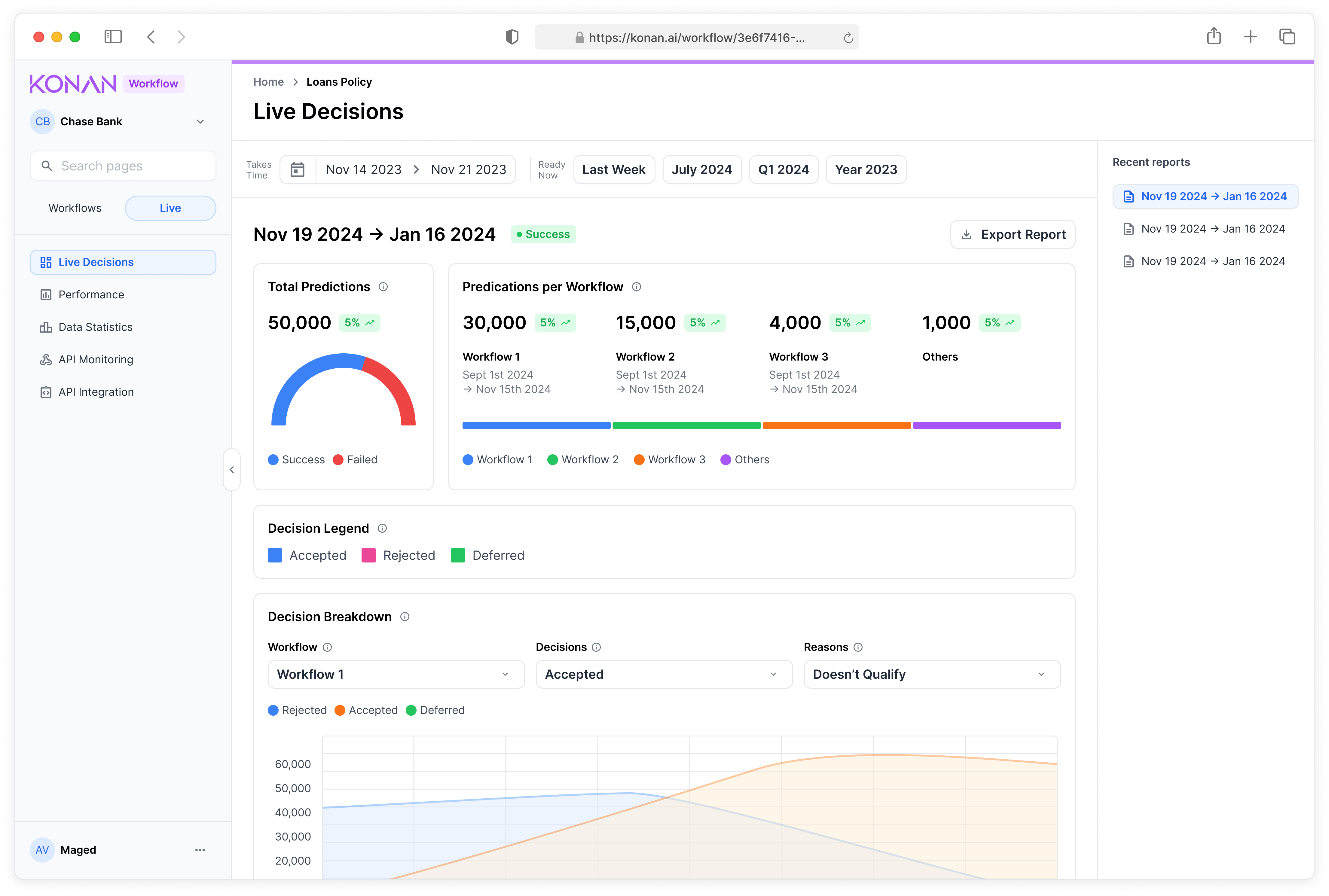

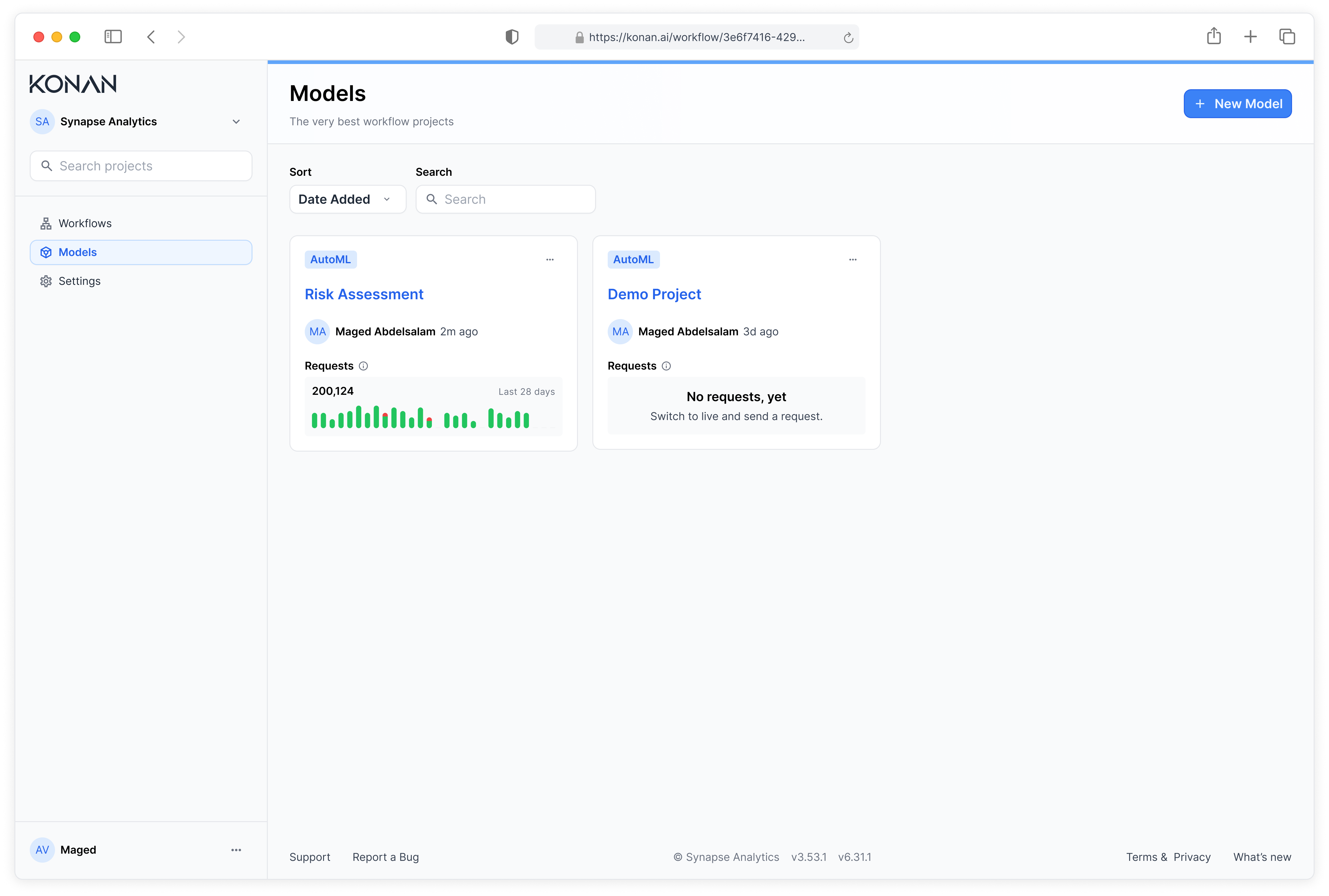

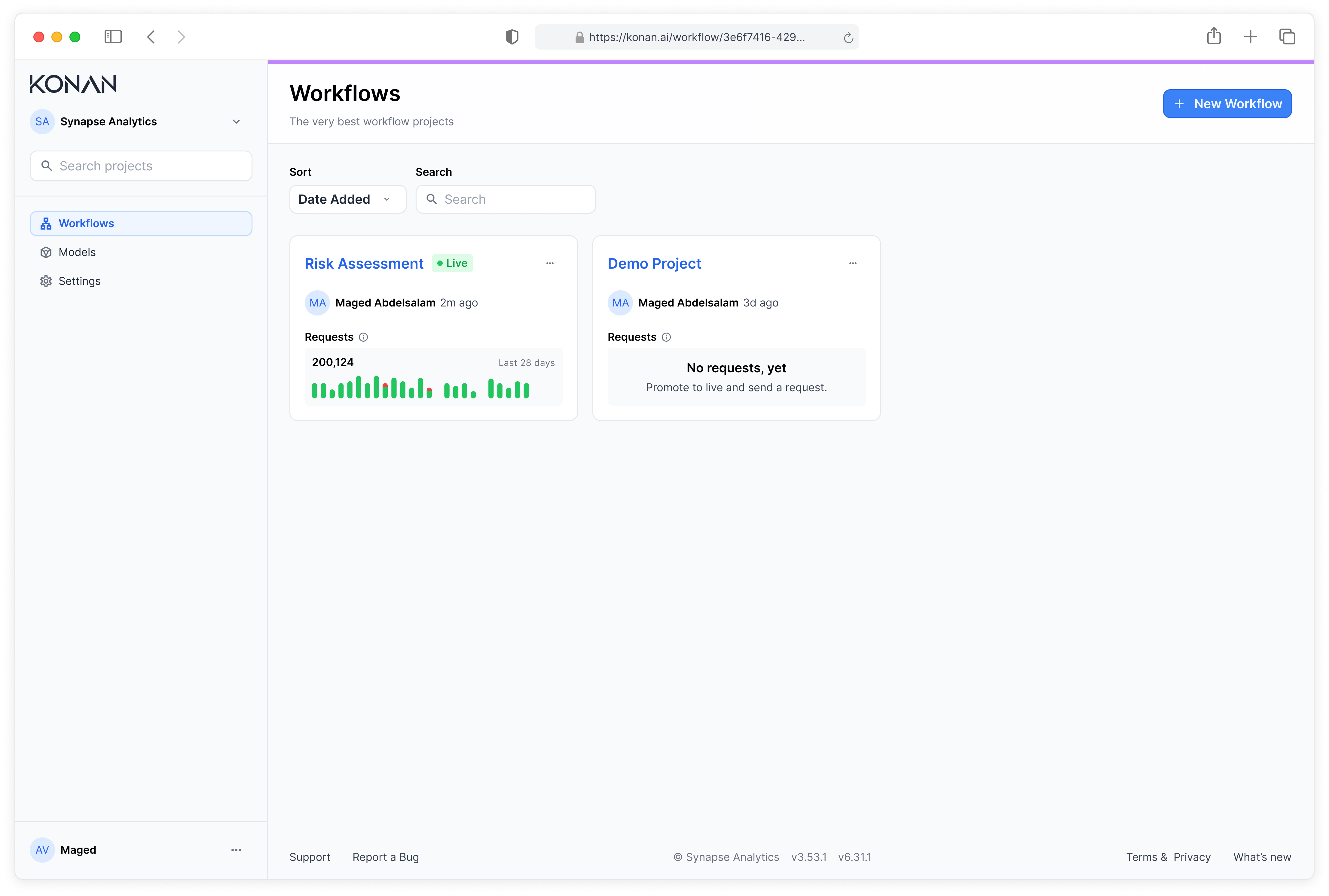

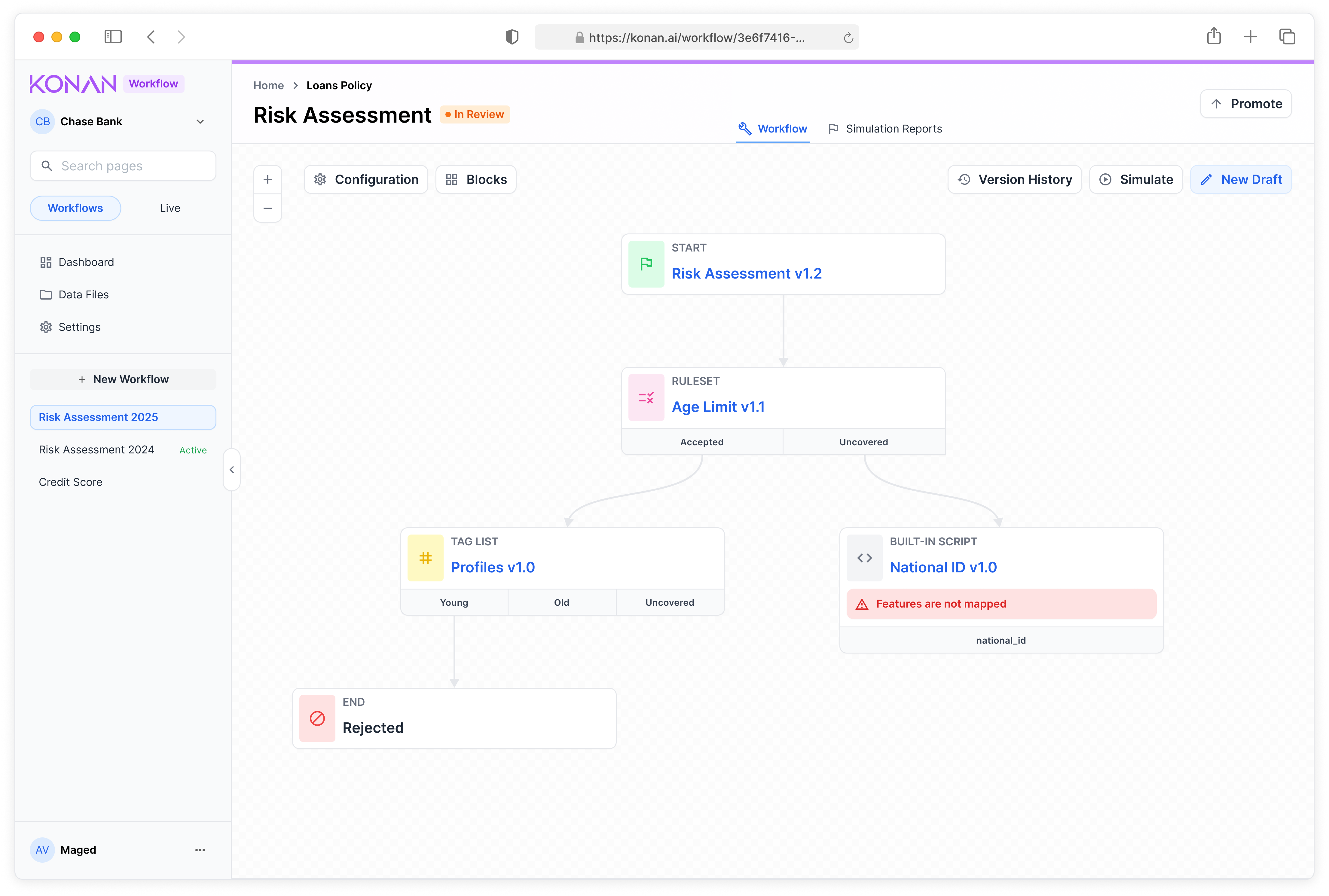

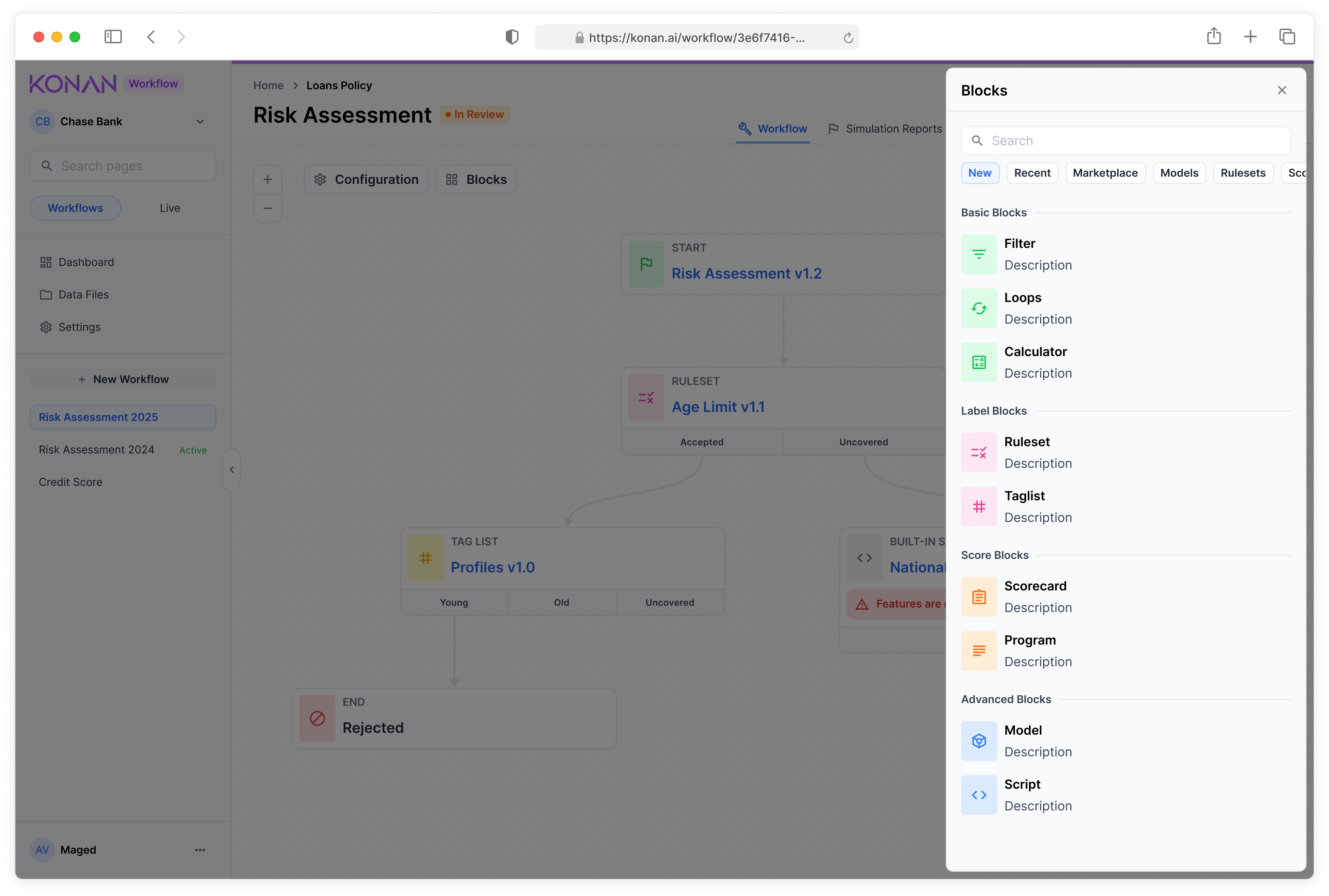

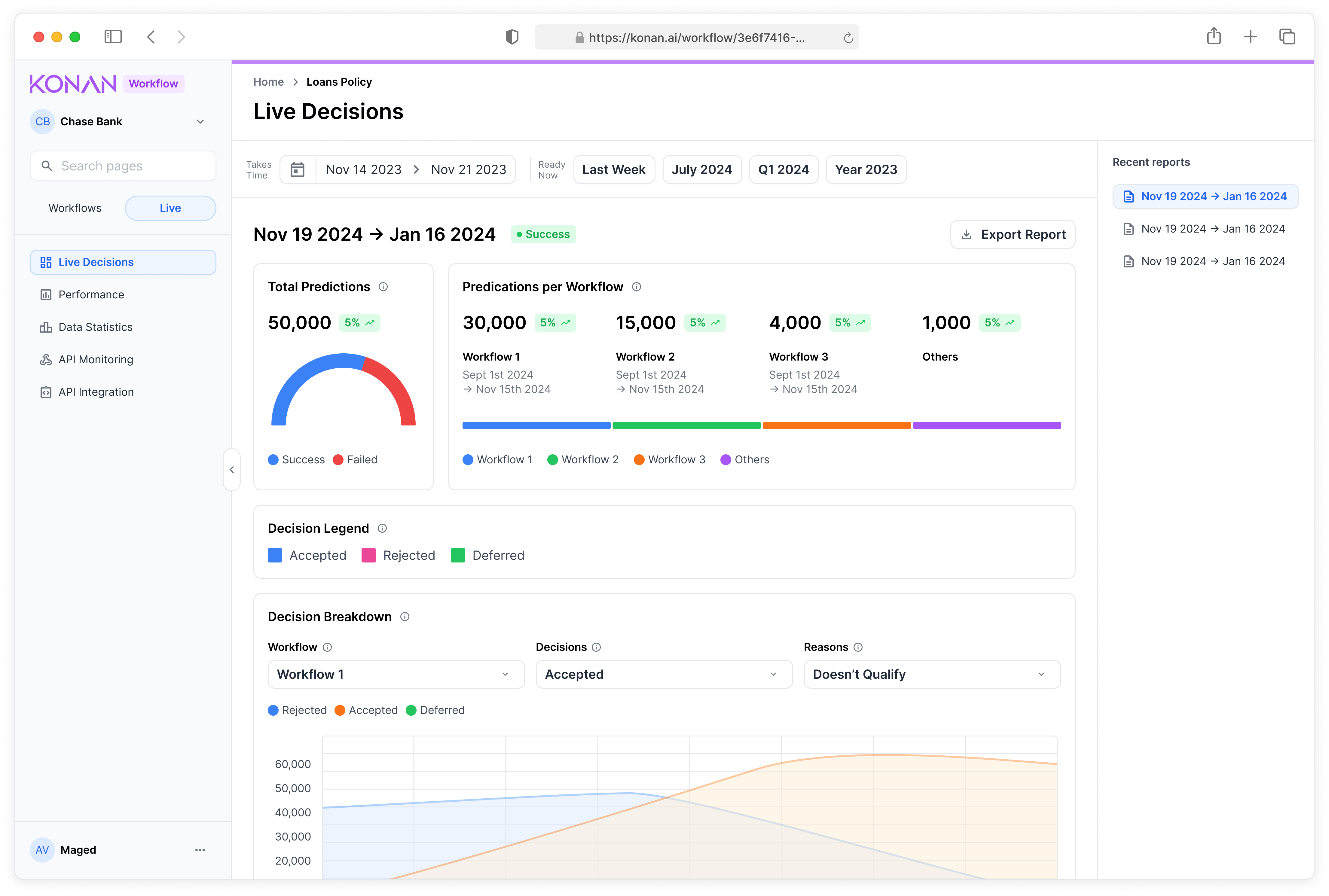

With deals secured and tight deadlines, I led the design of a comprehensive MLOps platform from scratch. Working with founders, PMs, and data scientists, we delivered:

- Model deployment and retraining pipelines

- A/B testing and model comparison tools

- Real-time monitoring and analytics dashboards

When Success Revealed the Real Problem

We need to scale. Let's focus on Banks

Phase 1 worked, but only for data scientists. Business users found it too technical. Through customer interviews, I discovered the real opportunity: banks and financial companies desperately needed fraud prevention tools.

I made a bold decision: convince a team obsessed with "pure AI" to pivot toward "AI with human intervention."

This required a completely new design philosophy:

- Point-and-click simplicity over technical complexity

- Smart defaults and explanations for non-technical users

- Business language instead of technical jargon

Understanding the Reality Gap

We need rules, not just AI. AI doesn't give us the control we need for compliance

With the new direction set, I conducted deep user research to validate our approach. Here's how I structured the research to get actionable insights:

Research Design & Methodology

- Participant recruitment: 6 risk officers from 4 financial institutions

- Method mix: 1-hour contextual interviews + 30-minute task-based usability sessions

- Interview protocol: Jobs-to-be-done framework focusing on current decision-making workflows

- Usability testing: Prototype testing with think-aloud protocol on core workflow creation tasks

Research Synthesis Process

- Affinity mapping of all interview insights with cross-functional team

- Behavioral pattern identification using journey mapping techniques

- Quantified pain points using task success rates and time-to-completion metrics

- Created user mental models diagrams to guide design decisions

What I discovered was eye-opening:

- Rule-based workflows preferred: Users wanted AI-assisted decision making, not AI-only automation

- AI skepticism was real: Risk officers couldn't yet see clear value in pure AI models for compliance-heavy decisions

- Responsibility shifting problem: Users avoided making policy changes directly in the software, fearing accountability issues

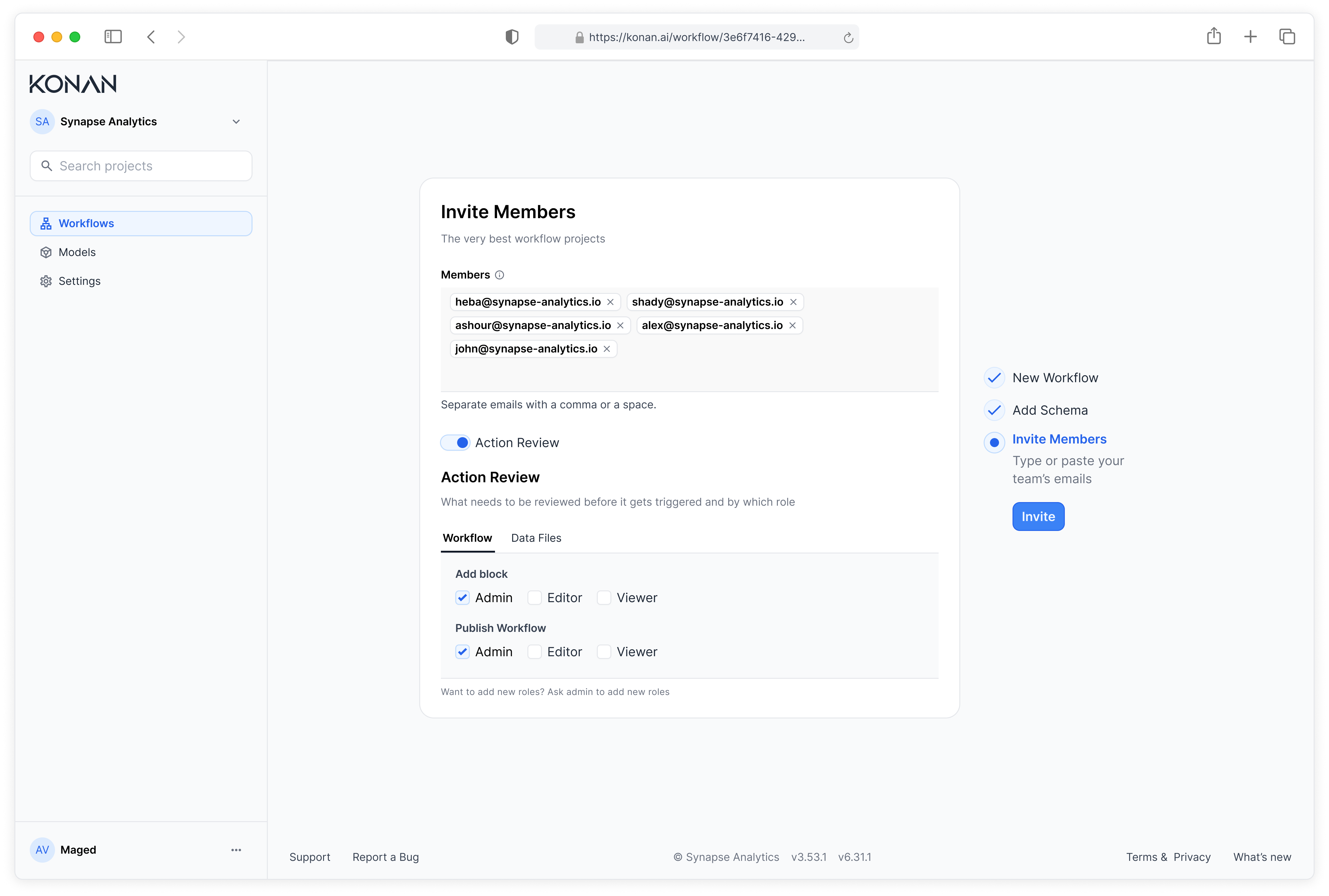

Based on these insights, I designed new features that addressed the core adoption barriers:

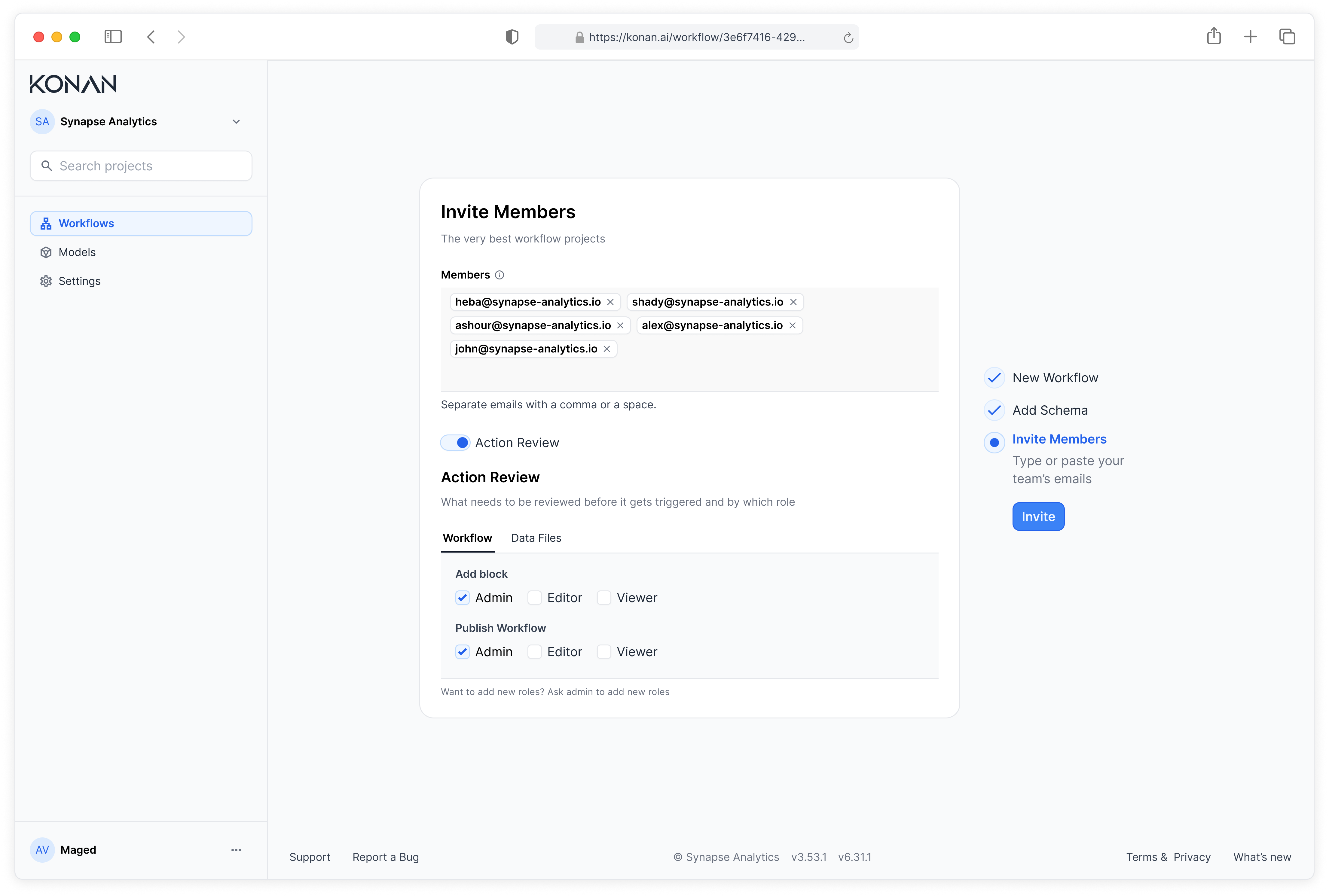

- Draft mode: Safe space for experimenting with policy changes

- Group approval workflows: Distributed responsibility and built institutional confidence

- Rule-AI hybrid approach: AI recommendations within rule-based frameworks

These research-driven features led to a 300% increase in software adoption and usage, proving that understanding user psychology is as crucial as technical capability.

Building a Design-Led Culture

Success brought new challenges: how to scale design across multiple teams while maintaining quality. This required as much stakeholder management as design skill.

Cross-Functional Alignment Strategy

- Executive buy-in: Created design ROI framework showing 60% dev velocity increase to secure hiring budget

- Engineering partnership: Embedded with teams during design system adoption, addressing technical concerns in real-time

- Product alignment: Established design review gates in product development process with clear success criteria

- Sales enablement: Created design artifacts that sales could use to communicate product differentiation

Team Building & Culture

- Hired 5 designers using structured design challenges that assessed both craft and collaboration skills

- Created design culture with weekly design critiques, monthly external speaker series, and quarterly design retreats

- Unified 3 product teams under one design system while respecting each team's unique user needs

- Built design-to-code pipeline: Figma → Storybook → Production with automated design token sync

Overcoming Resistance

- Engineering skepticism: Addressed performance concerns by benchmarking design system components vs. custom code

- Timeline pressures: Created phased adoption plan allowing teams to migrate components incrementally

- Design consistency concerns: Established component contribution process with design review and approval workflows

The Transformation

This was one of the most challenging pivots I've experienced, but we did it

Leading a team through a fundamental shift from pure AI to business-focused solutions wasn't easy, especially when most joined specifically for AI work.

The transformation was measurable:

- $250,000 in early deals from prototypes

- Successful market pivot to credit decisioning

- 5x design team growth with established practices

- 3 product teams unified under one design system

- Strong product-market fit in financial services

What this experience taught me about leadership:

- Sometimes the biggest impact comes from changing direction

- Building teams is as important as building products

- Design systems create exponential value across organizations

- Cultural change requires patience and persistence